tax benefit new

Public Provident Fund PPF Employees Provident Fund EPF Equity Linked Savings Scheme ELSS and National Pension System NPS are some of the most popular instruments used to save tax under Section 80C of Income Tax Act 1961 and to. If you have a spouse or common-law partner they also have to file a return every year.

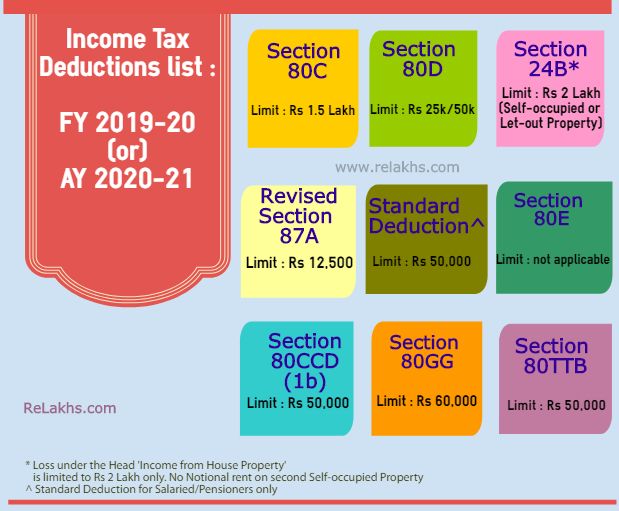

Income Tax Deductions List Fy 2019 20 List Of Important Income Tax Exemptions For Ay 2020 21 Tax Deductions List Tax Deductions Income Tax

If taxpayer Deepak Jains company puts Rs 8035 10 of his basic in the NPS on his behalf every month his annual tax will reduce by about Rs 22000.

. The value of these tax benefits would be substantially limited if American Airlines were to. The biggest difference between the two policies is that expatriates tax-exempt fringe benefits can be fully deducted based on the actual cost of each expenditure provided it is a reasonable amount the reasonable amount is judged based on the local living standard consumption level market price etc and accompanied by a corresponding invoice or other. An important tax planning note is that a QCD can be used to. The tax benefit preservation plan was adopted to protect an important asset of American Airlines that may have meaningful value to all American Airlines stockholders.

This would be an estimated 78000 kids in Montana not already receiving a tax credit. The finance ministry is ready to offer tax benefits for direct listing of shares overseas as well as for settlement of bonds which are part of global indices via Euroclear but is. Explore tax-benefit profile at Times of India for photos videos and latest news of tax-benefit. How Crypto Losses Could Result in Tax Benefits.

Rodney Davis R-Taylorville recently announced the Employer Participation in Repayment Act. You might also receive one other type of charitable giving tax benefit if you take the standard deduction. La soluzione ideale per integrare la pensione pubblica investire al meglio il proprio TFR e godere di tutti i vantaggi fiscali propri della tipologia di prodotto. You can count on us from A as in application to Z as in free tax zone for everything in Accounting Consulting and Taxation.

Here you can find more about the main sectors for which we work. Also find news photos and videos on tax. New car tax mandate could maximise benefits for drivers despite hybrid vehicle risk MAJOR car tax proposals may need to be introduced in the future to account for the Governments zero. Parents with children up to the age of 13 and who make less than an adjusted gross income of 125000 could be entitled to a payment up to 8000 in the new year.

NPS salary benefits can help Jain cut income tax by Rs 54000 Up to 10 of the basic salary put in the NPS on behalf of the employee is deductible under Sec 80CCD 2. Once you turn 70½ you can make QCDs from your IRA of up to 100000 annually per individual. Specifically you can take a 300. State lawmakers undertook some changes to the tax code in 2018 when they reduced the individual and corporate tax rates to 5 raised cigarette taxes and imposed a 6 sales tax on items that had.

Tax benefits Latest Breaking News Pictures Videos and Special Reports from The Economic Times. While an increase to the tax yield is good news Bolio cautioned in the letter that the surplus was a one-time benefit and advised that the state must be careful not to use it in ways that build ongoing costs which would need to be covered by future property taxes He also pointed out that the tax yield is one of several factors used to calculate property tax bills the. The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. These tax benefits can include the offset of tax liability arising from future taxable earnings or gains.

TaxBenefit New risponde alle novità introdotte dallultima riforma previdenziale e consente di costruirsi un. Zach GibsonGetty Images. For more than 20 years American taxpayers have been afforded a tax break for their children. Davis pushing new student loan tax benefit for employers By RFD Radio US.

That is why President Biden strongly believes that we should extend the. Israel announced new tax benefits for Israeli hi-tech workers living abroad as well as workers entitled to immigrate to Israel under the Law of Return. For the first time ever the credit is fully available to the families who need it most says Semmens. We support and give advice to our clients from sectors such as automotive.

It allows employers to make tax-free student loan payments on behalf of their employees and is an attempt to tackle the student loan crisis. Bidens American Rescue Plan increased the credit to 3000 a year added 17-year-olds and boosted the amount to 3600 for. Started as a 500 per child write-off under Bill Clinton in 1997 it changed over time and was beefed up under Donald Trumps GOP tax cuts in 2017. The Budget 2020 introduces a new regime under section 115BAC giving an option to individuals and HUF taxpayers to pay income tax at lower rates.

The Congressional Budget Office said on Thursday that over the course of a decade the changes to the deduction would amount to a tax increase that would raise about 148 billion in revenue. Latest and Breaking News on tax-benefit. The new system is applicable for income earned from 1 April 2020 FY 2020-21 which relates to AY 2021-22. The tax rates under the new tax regime and the existing tax regime are.

The IRS allows investors to take deductions on crypto losses that can reduce tax liabilities or even lead to a tax refund. According to policy analyst Jackie Semmens the change with this tax credit is that it would make it more accessible to lower-income families in Montana. File your income tax and benefit return T o continue receiving the benefit and credit payments that you are entitled to you have to file your income tax and benefit return on time every year even if you have no income in the year.

Lic Tax Saving Policy Best Insurance Life Insurance Policy Policies

Income Tax Deductions List Fy 2018 19 Income Tax Exemptions Tax Benefits Fy 2018 19 Ay 2019 20 Section 80c Limit Income Tax Tax Deductions List Tax Deductions

New Tax Benefit For Teachers And Eces Teachers Benefit Tax

Health Insurance Sec 80d Tax Deduction Fy 2020 21 Ay 2021 22 Income Tax Tax Forms Tax Deductions List

Old Or New Tax Slabs For Fy 2020 21 Amount At Which Tax Are Same Incometax Budget Unionbudget2020 Oldvsnew Income Tax Indirect Tax Budgeting

Posting Komentar untuk "tax benefit new"